March 1, 2024

At Bristol Gate, we are specialists in High Dividend Growth investing – a unique subset in the dividend universe. We firmly believe our unique approach, which combines the power of machine learning with deep-rooted fundamental analysis, gives us an advantage.

2023 was a strong year for our US Equity strategy as we outperformed our dividend-paying universe by a considerable margin (see Note 1). Looking forward, we believe there are robust return opportunities for the strategy, considering some of the current prevailing conditions:

- What does “passive” investing mean today?

Passive investing aims to provide investors with broad market exposure, based on the very simple logic that over time the market goes up. However, passively investing in the S&P 500 Index looks very different than how it has for most of its history.

Exhibit 1: S&P 500 Index Concentration and Earnings Contribution since 1996

Source: JPMorgan Guide to the Markets, Jan 31, 2024.

The S&P 500 Index today seems to have more in common with how it was constructed during the tech bubble and global financial crisis. Both the index’s concentration and the contribution to the total earnings of the index by its largest constituents are reflective of those periods. In both these past scenarios, market concentration was alleviated by sharp market drawdowns.

Although we are concentrated investors, we believe diversification needs to be mindful and having our largest weights determined by past performance does not seem prudent to us.

- Valuation matters

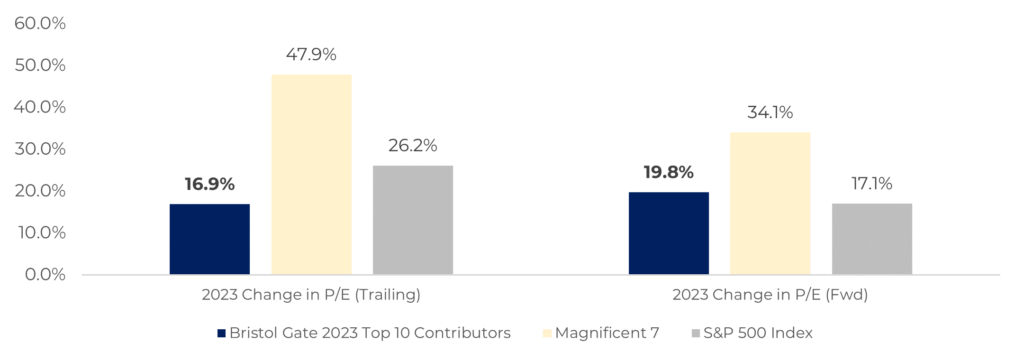

The Magnificent 7’s outsized weight in the S&P 500 also has an impact on the valuation for the broad market. That subset of stocks contributed over 60% of the Index’s total return in 2023. When compared with the top 10 contributors to our US Equity strategy’s returns, we can see how their valuation changed relative to our best performing names last year:

Exhibit 2: % Change in Valuation of Bristol Gate US Equity Strategy Top 10 Contributors, S&P 500 Index & Magnificent 7 in 2023

Source: Bristol Gate Capital Partners, Bloomberg. As of December 31, 2023

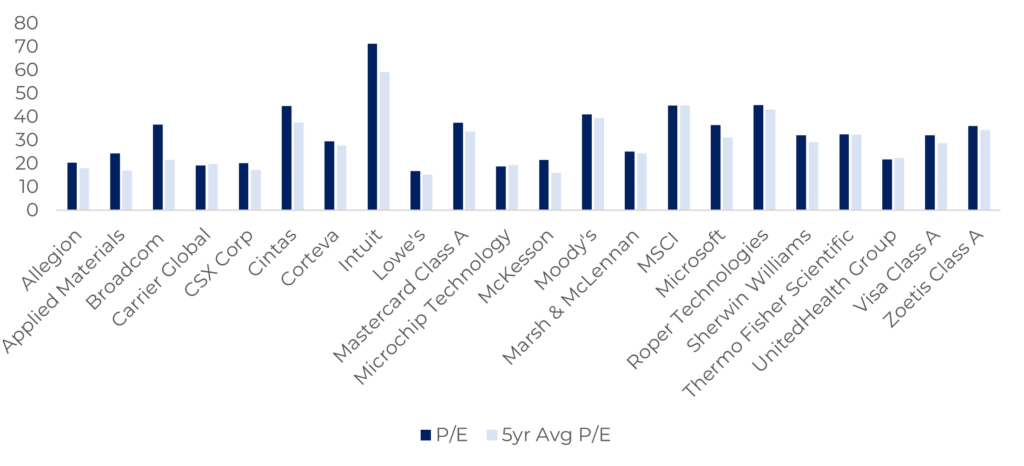

In fact, most of our portfolio companies are not trading at widely divergent levels relative to their 5-year average valuations:

Exhibit 3: % Current vs 5 Year Average P/E (Trailing) of Bristol Gate US Equity Strategy

Source: Bristol Gate Capital Partners, Bloomberg. As at Feb 16, 2024

As bottom-up investors, we are more comfortable with the valuations of the 22 stocks in our US Equity portfolio rather than those of the stocks that currently constitute the largest weights of the index, and as a result, will likely have a large impact on its returns.

- Our portfolio is constructed for all market environments.

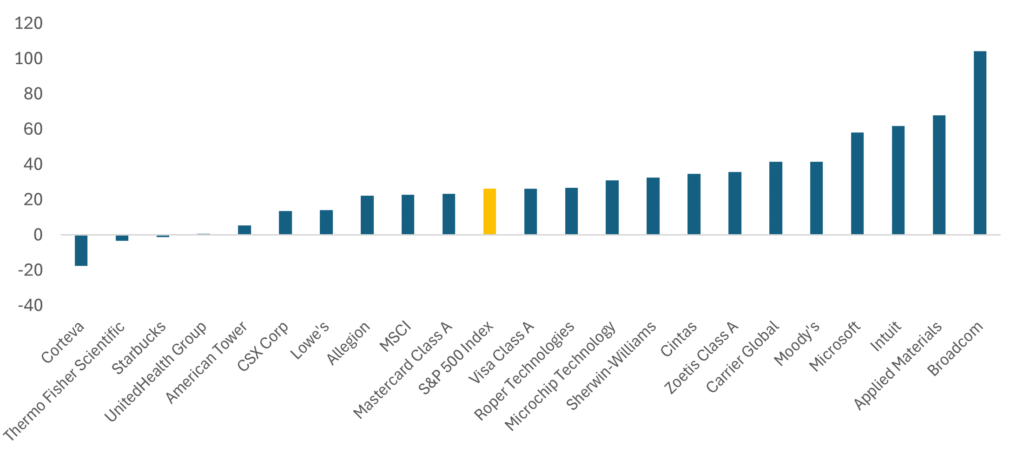

Our goal is to build a diversified portfolio, which means not all the companies will move in lockstep. These companies have different exposures that account for different risks at different times in a market cycle. By design, we expect our portfolio to have laggards in any given year as a result, and last year was no different:

Exhibit 4: Bristol Gate US Equity Strategy Holdings: 2023 Stock Total Return vs S&P 500 Index Total Return (%)

Source: Bristol Gate Capital Partners, Bloomberg. As of December 31, 2023

In the short term, we can not control what the price of a stock will do. It is affected by any number of reasons including macroeconomics, industry or company specific issues or even just sentiment. However, by focusing on what we can control and investing in companies with strong dividend growth prospects supported by high quality fundamentals, it becomes easier to withstand these fluctuations.

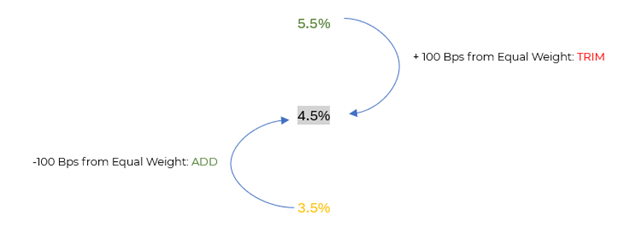

Our rebalancing approach seeks to take advantage of periods of market euphoria and fear. On rebalancing dates, we add to positions that fall below a predefined threshold and subtract from positions that rise above a higher threshold. By following this contrarian process, we seek to reduce valuation risk while trying to maximize the potential internal rate of return of our portfolio over time.

Bristol Gate Systematic, Contrarian Rebalancing Approach

For Illustrative Purposes Only. Source: Bristol Gate Capital Partners.

We are diligently focused on seeking out high quality companies that are growing their dividends at high rates, ensuring we pay a fair price for them. Our conviction in our unique approach and disciplined process supports our belief that our clients will benefit over the long-term.

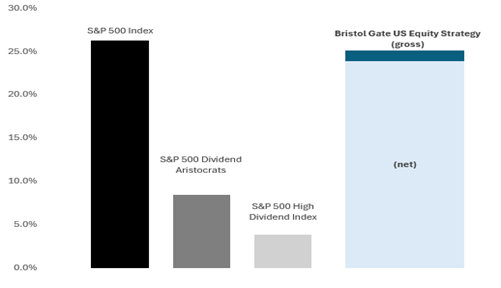

Note 1: 2023 Returns.

Source: Bristol Gate Capital Partners, Morningstar Direct.

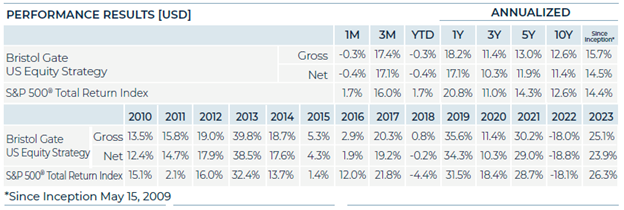

Performance Disclosure (As at January 31, 2024):

Important Disclosures

There is a risk of loss inherent in any investment; past performance is not indicative of future results. Prospective and existing investors in Bristol Gate’s pooled funds or ETF funds should refer to the fund’s offering documents which outline the risk factors associated with a decision to invest. Separately managed account clients should refer to disclosure documents provided which outline risks of investing. Pursuant to SEC regulations, a description of risks associated with Bristol Gate’s strategies is also contained in Bristol Gate’s Form ADV Part 2A located at www.bristolgate.com/regulatory-documents.

US Equity Strategy returns in this report refer to the Bristol Gate US Equity Strategy Composite (the “Composite”). The Composite consists of equities of publicly traded, dividend paying US companies. The Composite is valued in US Dollars and for comparison purposes is measured against the S&P 500 Total Return Index. The composite’s Investment Advisor, Bristol Gate Capital Partners Inc., defines itself as a portfolio manager, exempt market dealer and investment fund manager (as per its registration in Ontario, its principal regulator in Canada) and is also a Registered Investment Adviser with the U.S. Securities and Exchange Commission (the “SEC”). The Investment Advisor’s objective is to select companies with positive dividend growth, and which collectively will generate over the long term a growing income and capital appreciation for investors. The inception date of the Composite is May 15, 2009. The US Dollar is the currency used to measure performance, which is presented on a gross and net basis and includes the reinvestment of investment income. The composite’s gross return is gross of withholding tax prior to January 1, 2017 and is net of withholding tax thereafter. Net returns are calculated by reducing the gross returns by the maximum management fee charged by Bristol Gate of 1%, applied monthly. Actual investment advisory fees incurred by clients may vary. There is the opportunity for the use of leverage up to 30% of the net asset value of the underlying investments using a margin account at the prime broker. Thus far no material leverage has been utilized. An investor’s actual returns may be reduced by management fees, performance fees, and other operating expenses that may be incurred because of the management of the composite. A performance fee may also be charged on some accounts and funds managed by the firm. Bristol Gate claims compliance with the Global Investment Performance Standards (GIPS®). GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein. To obtain a GIPS Composite Report, please email us at info@bristolgate.com.

The S&P 500® Total Return Index measures the performance of the broad US equity market, including dividend re-investment, in US dollars. This index is provided for information only and comparisons to the index has limitations. The benchmark is an appropriate standard against which the performance of the strategy can be measured over longer time periods as it represents the primary investment universe from which Bristol Gate selects securities. However, Bristol Gate’s portfolio construction process differs materially from that of the benchmark and the securities selected for inclusion in the strategy are not influenced by the composition of the benchmark. For example, the strategy is a concentrated portfolio of approximately equally weighted dividend-paying equity securities, rebalanced quarterly whereas the benchmark is a broad stock index (including both dividend and non-dividend paying equities) that is market capitalization weighted. As such, strategy performance deviations relative to the benchmark may be significant, particularly over shorter time periods. The strategy has concentrated investments in a limited number of companies; as a result, a change in one security’s value may have a more significant effect on the strategy’s value.

S&P 500 ® Total Return Dividend Aristocrats Index measures the performance of a subset of S&P 500® Index companies that have increased their dividends every year for the last 25 consecutive years. This Index has limited relevancy to our approach as it focuses on historical dividend growth, whereas Bristol Gate’s US Equity strategy’s securities are selected based on future dividend growth.

S&P 500 ® High Dividend Index is designed to measure the performance of 80 high yield companies within the S&P 500 and is equally weighted to best represent the performance of this group, regardless of constituent size. This Index has limited relevancy to our approach as it focuses on dividend yield, whereas Bristol Gate’s US Equity strategy’s securities are selected based on future dividend growth.

SPDR® S&P 500® ETF Trust (SPY US) sourced from Bloomberg has been used as a proxy for the S&P 500® Total Return Index for the purpose of providing non-return-based portfolio statistics and sector weightings in this report. SPY US is an ETF that seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of the S&P 500® Index.

This Report is for information purposes and should not be construed under any circumstances as a public offering of securities in any jurisdiction in which an offer or solicitation is not authorized. Prospective investors in Bristol Gate’s pooled funds or ETF funds should rely solely on the fund’s offering documents, which outline the risk factors associated with a decision to invest. No representations or warranties of any kind are intended or should be inferred with respect to the economic return or the tax implications of any investment in a Bristol Gate fund.

This piece is presented for illustrative and discussion purposes only. It should not be considered as personal investment advice or an offer or solicitation to buy and/or sell securities and it does not consider unique objectives, constraints, or financial needs of the individual. Under no circumstances does this piece suggest that you should time the market in any way or make investment decisions based on the content. Investors are advised that their investments are not guaranteed, their values change frequently, and past performance may not be repeated. References to specific securities are presented to illustrate the application of our investment philosophy only, do not represent all of the securities purchased, sold or recommended for the portfolio, and it should not be assumed that investments in the securities identified were or will be profitable and should not be considered recommendations by Bristol Gate Capital Partners Inc. A full list of security holdings is available upon request. For more information contact Bristol Gate Capital Partners Inc. directly. The information contained in this piece is the opinion of Bristol Gate Capital Partners Inc. and/or its employees as of the date of the piece and is subject to change without notice. Every effort has been made to ensure accuracy in this piece at the time of publication; however, accuracy cannot be guaranteed. Market conditions may change and Bristol Gate Capital Partners Inc. accepts no responsibility for individual investment decisions arising from the use of or reliance on the information contained herein. We strongly recommend you consult with a financial advisor prior to making any investment decisions. Please refer to the Legal section of Bristol Gate’s website for additional information at bristolgate.com.

A Note About Forward-Looking Statements

This report may contain forward-looking statements including, but not limited to, statements about the Bristol Gate strategies, risks, expected performance and condition. Forward-looking statements include statements that are predictive in nature, that depend upon or refer to future events and conditions or include words such as “may”, “could”, “would”, “should”, “expect”, “anticipate”, “intend”, “plan”, “believe”, “estimate” and similar forward-looking expressions or negative versions thereof.

These forward-looking statements are subject to various risks, uncertainties and assumptions about the investment strategies, capital markets and economic factors, which could cause actual financial performance and expectations to differ materially from the anticipated performance or other expectations expressed. Economic factors include, but are not limited to, general economic, political and market factors in North America and internationally, interest and foreign exchange rates, global equity and capital markets, business competition, technological change, changes in government regulations, unexpected judicial or regulatory proceedings, and catastrophic events.

Readers are cautioned not to place undue reliance on forward-looking statements and consider the above-mentioned factors and other factors carefully before making any investment decisions. All opinions contained in forward-looking statements are subject to change without notice and are provided in good faith. Forward-looking statements are not guarantees of future performance, and actual results could differ materially from those expressed or implied in any forward-looking statements. Bristol Gate Capital Partners Inc. has no specific intention of updating any forward-looking statements whether as a result of new information, future events or otherwise, except as required by securities legislation.

Takes 2 minutes

Takes 2 minutes