September 1, 2023

Through the third quarter of the year, it may be easy to forget that the market was solely focused on whether we were about to enter a central bank-induced recession. Instead, coming off the worst year for the S&P 500 since 2008, the market has shrugged off rising rates, inflationary headwinds and the lackadaisical corporate revenue and earnings growth to deliver strong returns.

In particular, a small subset of stocks, colloquially known as “the Magnificent Seven”[1] have contributed the lion’s share of the index’s returns this year. After a challenging year for technology stocks and the enthusiasm for all things AI, we can appreciate why investors are hungry for the extravagant revenue and earnings growth numbers these businesses have delivered. We have previously discussed how we believe we’re responsibly investing in companies that are poised to benefit from the long-term secular growth trends due to the significant investments being made in Artificial Intelligence.

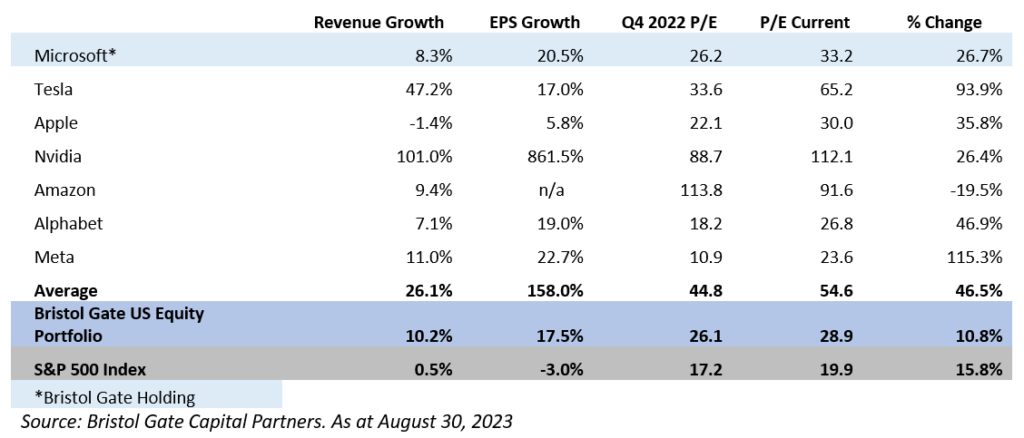

Given the spotlight on these companies, however, it is prudent to emphasize that their valuation multiples have adjusted accordingly:

Exhibit 1: Revenue and EPS Growth and Change in P/E from Q4 2022 to Q2 2023

As bottom-up investors we are required to look to the future when evaluating potential investments with our client’s capital. Too often when companies trade at lofty valuations it is due to, at best, overly optimistic and, at worst, unrealistic projections for future growth. While not bargain hunters, our approach focuses on being confident that we don’t overpay for a business. We keep in mind the old investing adage that a great business can be a poor investment if you pay too much for it.

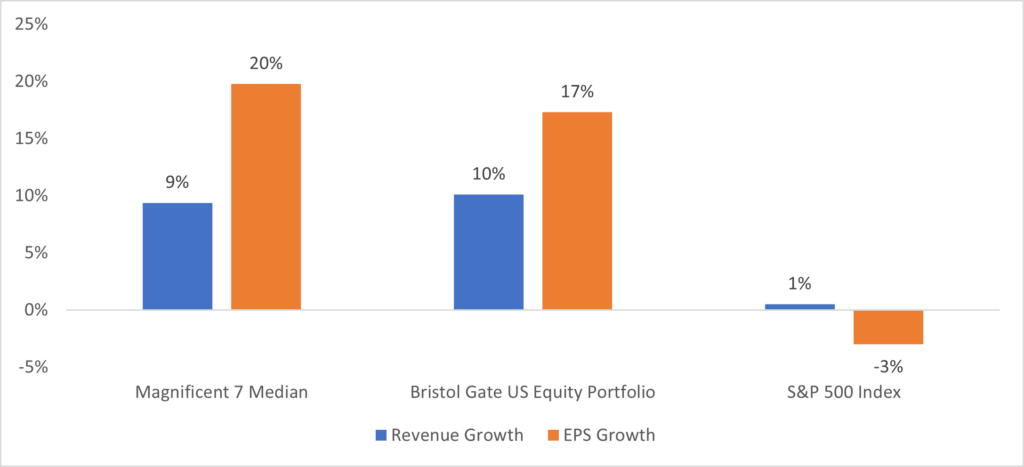

In our view, despite their impressive short-term growth trajectories, the current valuations for some of these companies leave little room for error. Any speedbump in delivering on those rosy growth assumptions represents significant risk. In contrast, we feel our US Equity strategy is much more reasonably priced while delivering vastly superior revenue and earnings growth relative to the market – with fundamental results that are in line with the Magnificent Seven.

Exhibit 2: Median Revenue and EPS Growth

Source: Bristol Gate Capital Partners, Bloomberg. As at August 30, 2023.

Every so often, a few companies are given the limelight and become market darlings, but it is rare they can live up to the height of their expectations. Opportunities for long-term investors are those businesses that are being ignored by the masses. Our focus on high dividend growth companies leads us into high quality, growing businesses without nosebleed valuations. For any investor, paying for growth is unavoidable, but why not pay less?

[1] Magnificent Seven Stocks: Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla.

Important Disclosures

There is a risk of loss inherent in any investment; past performance is not indicative of future results. Prospective and existing investors in Bristol Gate’s pooled funds or ETF funds should refer to the fund’s offering documents which outline the risk factors associated with a decision to invest. Separately managed account clients should refer to disclosure documents provided which outline risks of investing. Pursuant to SEC regulations, a description of risks associated with Bristol Gate’s strategies is also contained in Bristol Gate’s Form ADV Part 2A located at www.bristolgate.com/regulatory-documents.

This piece is presented for illustrative and discussion purposes only. It should not be considered as personal investment advice or an offer or solicitation to buy and/or sell securities and it does not consider unique objectives, constraints, or financial needs of the individual. Under no circumstances does this piece suggest that you should time the market in any way or make investment decisions based on the content. Investors are advised that their investments are not guaranteed, their values change frequently, and past performance may not be repeated. References to specific securities are presented to illustrate the application of our investment philosophy only, do not represent all of the securities purchased, sold or recommended for the portfolio, it should not be assumed that investments in the securities identified were or will be profitable and should not be considered recommendations by Bristol Gate Capital Partners Inc. A full list of security holdings is available upon request. For more information contact Bristol Gate Capital Partners Inc. directly. The information contained in this piece is the opinion of Bristol Gate Capital Partners Inc. and/or its employees as of the date of the piece and is subject to change without notice. Every effort has been made to ensure accuracy in this piece at the time of publication; however, accuracy cannot be guaranteed. Market conditions may change and Bristol Gate Capital Partners Inc. accepts no responsibility for individual investment decisions arising from the use of or reliance on the information contained herein. We strongly recommend you consult with a financial advisor prior to making any investment decisions. Please refer to the Legal section of Bristol Gate’s website for additional information at bristolgate.com.

A Note About Forward-Looking Statements

This report may contain forward-looking statements including, but not limited to, statements about the Bristol Gate strategies, risks, expected performance and condition. Forward-looking statements include statements that are predictive in nature, that depend upon or refer to future events and conditions or include words such as “may”, “could”, “would”, “should”, “expect”, “anticipate”, “intend”, “plan”, “believe”, “estimate” and similar forward-looking expressions or negative versions thereof.

These forward-looking statements are subject to various risks, uncertainties and assumptions about the investment strategies, capital markets and economic factors, which could cause actual financial performance and expectations to differ materially from the anticipated performance or other expectations expressed. Economic factors include, but are not limited to, general economic, political and market factors in North America and internationally, interest and foreign exchange rates, global equity and capital markets, business competition, technological change, changes in government regulations, unexpected judicial or regulatory proceedings, and catastrophic events. Readers are cautioned not to place undue reliance on forward-looking statements and consider the above-mentioned factors and other factors carefully before making any investment decisions. All opinions contained in forward-looking statements are subject to change without notice and are provided in good faith. Forward-looking statements are not guarantees of future performance, and actual results could differ materially from those expressed or implied in any forward-looking statements. Bristol Gate Capital Partners Inc. has no specific intention of updating any forward-looking statements whether as a result of new information, future events or otherwise, except as required by securities legislation.

Takes 2 minutes

Takes 2 minutes