December 11, 2024

Much has been made about how the current market environment, characterized by a heightened focus on a select group of mega-cap stocks, has been a challenging one for active managers. The market also presents a similarly unprecedented opportunity for active managers looking forward, as history suggests that such extreme concentration is unlikely to persist indefinitely. This contrast underscores why we don’t believe the active vs passive debate is a simple binary choice; there is room for both in investor portfolios.

At Bristol Gate, we have identified high-quality, high dividend growth companies as an attractive subset of the market to find great businesses. Our knowledge and confidence of this area of the market allows us to build concentrated portfolios of just 22 of these companies. By ignoring the rest of the market, it’s clear our investment philosophy is based on a belief in active management.

Like everything we do, this philosophy is deeply rooted in evidence-based academic research. In 2009, academics Martijn Cremers and Antti Petajisto introduced the concept of Active Share as a measure of active portfolio management. The measure captures the proportion of a portfolio’s holdings that differ from those of the benchmark index. The results of their study indicated that funds that outperformed were more likely to look meaningfully different from the index. We believe that achieving superior returns requires a willingness to deviate from the benchmark index. In this vein, our portfolios have consistently stood out – an output of our unique investment process.

Bristol Gate’s US Equity Strategy’s Active Share since inception and is currently 87% and has averaged about 90% since inception. To put that in context, the current Active Share for US Large Cap Core Equity funds averages just over 60%.

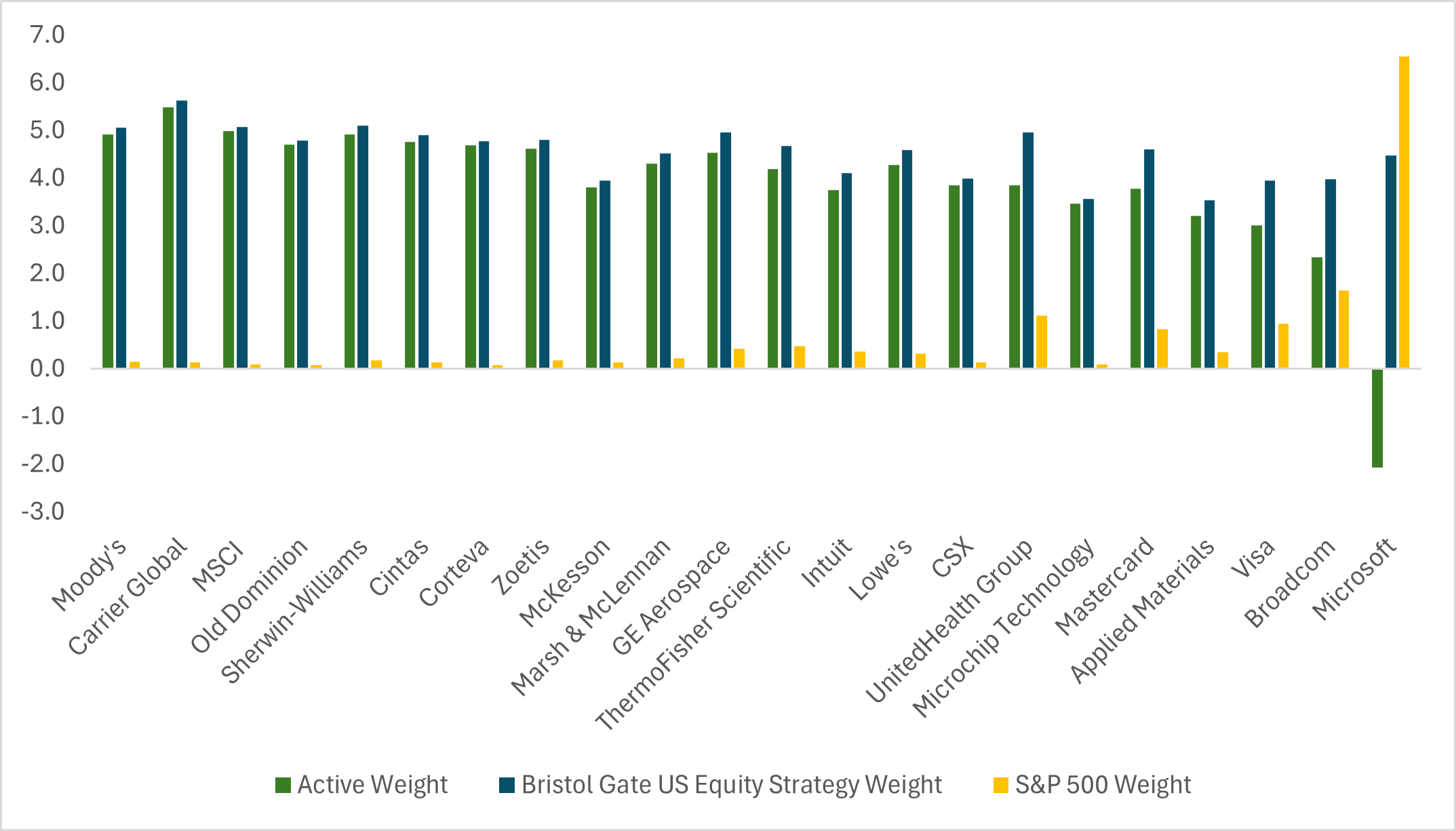

Exhibit 1: Weights of Bristol Gate Portfolio Companies in the S&P 500

Source: Bristol Gate Capital Partners, Bloomberg. As at Sep 30, 2024.

Why does this matter now? While others are overly focused on how much of the broad market is made up by a handful of stocks, we believe the opportunity going forward lies in the stocks that are being ignored not only in the minds of investors, but also by the index. Outside of Microsoft, which is one of the largest weights in the index, the other 21 companies in our US Equity portfolio have a combined weight in the S&P 500 Index of just 8%. As such, investors who own our US Equity strategy are diversifying the risks of the current markets and, in our view, improving their forward return prospects whenever the largest weights in the index underperform the rest of the companies in the benchmark for a prolonged period.

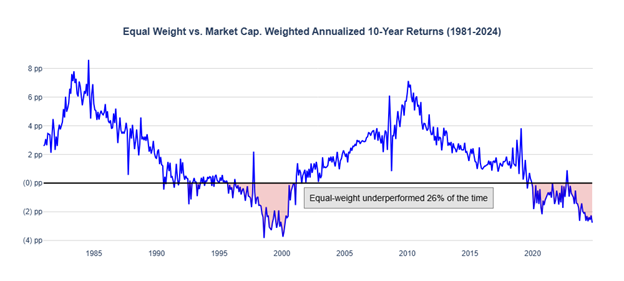

We can see previous instances where the equal-weight S&P 500 has outperformed the market-cap weighted index over long periods of time, giving us confidence that the odds are tilted in our favour.

Exhibit 2: Equal Weight vs Market Cap. S&P 500 Index

Source: Morningstar, Bristol Gate Capital Partners. Jan 1, 1981 to Sep 30, 2024

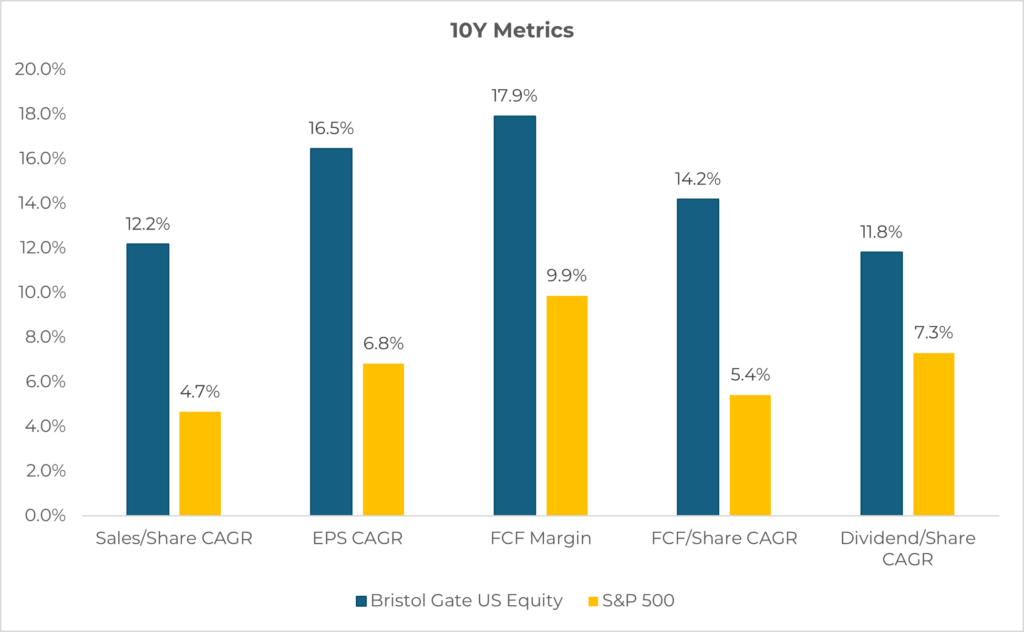

More importantly, whenever this narrowness of the market unwinds in a sustained way, we believe that it is companies with strong fundamentals that may not have been recognized by the market that will be rewarded. We think this is also to our benefit, given the quality of companies that we can consistently unearth in the high dividend growth universe of stocks. We make no guesses as to when that may be, but what is not in question is the sustained quality of the companies in our portfolio:

Exhibit 3: Quality metrics

Source: Bristol Gate Capital Partners, Bloomberg. As at September 30, 2024. There is a risk of loss inherent in any investment; past performance is not indicative of future results – please see disclosures.

Long term success in the markets is achieved through discipline and patience. We focus on owning high-quality companies which are delivering rapid dividend growth. When those companies are underrepresented in the index, we believe our portfolios are well-positioned to deliver sustainable long-term value for our clients.

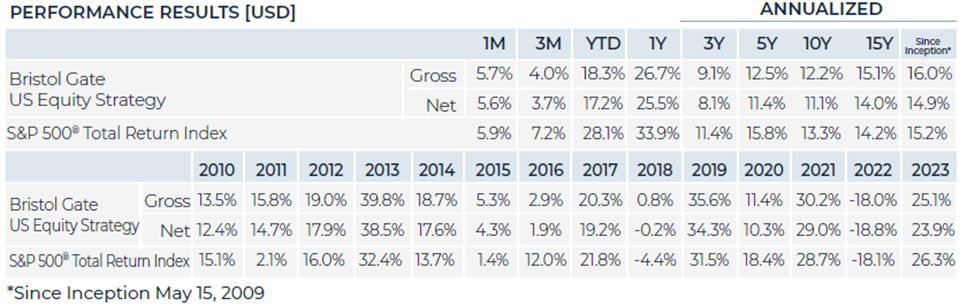

Performance Disclosure (As at November 30, 2024):

Important disclosures

There is a risk of loss inherent in any investment; past performance is not indicative of future results. Prospective and existing investors in Bristol Gate’s pooled funds or ETF funds should refer to the fund’s offering documents which outline the risk factors associated with a decision to invest. Separately managed account clients should refer to disclosure documents provided which outline risks of investing. Pursuant to SEC regulations, a description of risks associated with Bristol Gate’s strategies is also contained in Bristol Gate’s Form ADV Part 2A located at www.bristolgate.com/regulatory-documents.

US Equity Strategy returns in this report refer to the Bristol Gate US Equity Strategy Composite (the “Composite”). The Composite consists of equities of publicly traded, dividend paying US companies. The Composite is valued in US Dollars and for comparison purposes is measured against the S&P 500 Total Return Index. The composite’s Investment Advisor, Bristol Gate Capital Partners Inc., defines itself as a portfolio manager, exempt market dealer and investment fund manager (as per its registration in Ontario, its principal regulator in Canada) and is also a Registered Investment Adviser with the U.S. Securities and Exchange Commission (the “SEC”). The Investment Advisor’s objective is to select companies with positive dividend growth, and which collectively will generate over the long term a growing income and capital appreciation for investors. The inception date of the Composite is May 15, 2009. The US Dollar is the currency used to measure performance, which is presented on a gross and net basis and includes the reinvestment of investment income. The composite’s gross return is gross of withholding tax prior to January 1, 2017 and is net of withholding tax thereafter. Net returns are calculated by reducing the gross returns by the maximum management fee charged by Bristol Gate of 1%, applied monthly. Actual investment advisory fees incurred by clients may vary. There is the opportunity for the use of leverage up to 30% of the net asset value of the underlying investments using a margin account at the prime broker. Thus far no material leverage has been utilized. An investor’s actual returns may be reduced by management fees, performance fees, and other operating expenses that may be incurred because of the management of the composite. A performance fee may also be charged on some accounts and funds managed by the firm. Bristol Gate claims compliance with the Global Investment Performance Standards (GIPS®). GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein. To obtain a GIPS Composite Report, please email us at info@bristolgate.com.

The S&P 500® Total Return Index measures the performance of the broad US equity market, including dividend re-investment, in US dollars. This index is provided for information only and comparisons to the index has limitations. The benchmark is an appropriate standard against which the performance of the strategy can be measured over longer time periods as it represents the primary investment universe from which Bristol Gate selects securities. However, Bristol Gate’s portfolio construction process differs materially from that of the benchmark and the securities selected for inclusion in the strategy are not influenced by the composition of the benchmark. For example, the strategy is a concentrated portfolio of approximately equally weighted dividend-paying equity securities, rebalanced quarterly whereas the benchmark is a broad stock index (including both dividend and non-dividend paying equities) that is market capitalization weighted. As such, strategy performance deviations relative to the benchmark may be significant, particularly over shorter time periods. The strategy has concentrated investments in a limited number of companies; as a result, a change in one security’s value may have a more significant effect on the strategy’s value.

This Report is for information purposes and should not be construed under any circumstances as a public offering of securities in any jurisdiction in which an offer or solicitation is not authorized. Prospective investors in Bristol Gate’s pooled funds or ETF funds should rely solely on the fund’s offering documents, which outline the risk factors associated with a decision to invest. No representations or warranties of any kind are intended or should be inferred with respect to the economic return or the tax implications of any investment in a Bristol Gate fund.

This piece is presented for illustrative and discussion purposes only. It should not be considered as personal investment advice or an offer or solicitation to buy and/or sell securities and it does not consider unique objectives, constraints, or financial needs of the individual. Under no circumstances does this piece suggest that you should time the market in any way or make investment decisions based on the content. Investors are advised that their investments are not guaranteed, their values change frequently, and past performance may not be repeated. References to specific securities are presented to illustrate the application of our investment philosophy only, do not represent all of the securities purchased, sold or recommended for the portfolio, it should not be assumed that investments in the securities identified were or will be profitable and should not be considered recommendations by Bristol Gate Capital Partners Inc. A full list of security holdings is available upon request. For more information contact Bristol Gate Capital Partners Inc. directly. The information contained in this piece is the opinion of Bristol Gate Capital Partners Inc. and/or its employees as of the date of the piece and is subject to change without notice. Every effort has been made to ensure accuracy in this piece at the time of publication; however, accuracy cannot be guaranteed. Market conditions may change and Bristol Gate Capital Partners Inc. accepts no responsibility for individual investment decisions arising from the use of or reliance on the information contained herein. We strongly recommend you consult with a financial advisor prior to making any investment decisions. Please refer to the Legal section of Bristol Gate’s website for additional information at bristolgate.com.

A Note About Forward-Looking Statements: This report may contain forward-looking statements including, but not limited to, statements about the Bristol Gate strategies, risks, expected performance and condition. Forward-looking statements include statements that are predictive in nature, that depend upon or refer to future events and conditions or include words such as “may”, “could”, “would”, “should”, “expect”, “anticipate”, “intend”, “plan”, “believe”, “estimate” and similar forward-looking expressions or negative versions thereof.

These forward-looking statements are subject to various risks, uncertainties and assumptions about the investment strategies, capital markets and economic factors, which could cause actual financial performance and expectations to differ materially from the anticipated performance or other expectations expressed. Economic factors include, but are not limited to, general economic, political and market factors in North America and internationally, interest and foreign exchange rates, global equity and capital markets, business competition, technological change, changes in government regulations, unexpected judicial or regulatory proceedings, and catastrophic events. Readers are cautioned not to place undue reliance on forward-looking statements and consider the above-mentioned factors and other factors carefully before making any investment decisions. All opinions contained in forward-looking statements are subject to change without notice and are provided in good faith. Forward-looking statements are not guarantees of future performance, and actual results could differ materially from those expressed or implied in any forward-looking statements. Bristol Gate Capital Partners Inc. has no specific intention of updating any forward-looking statements whether as a result of new information, future events or otherwise, except as required by securities legislation.

Takes 2 minutes

Takes 2 minutes