July 24, 2024

“What’s past is prologue” – Shakespeare, The Tempest

Prudent risk management demands that we try to be aware of as many possible risks that exist in our companies, the market, and subsequently in our client portfolios. Today’s U.S. equity markets have been led by a narrow list of technology stocks which account for an astounding 59% of the S&P 500 return year-to-date. This concentration of return is reminiscent of the New Economy boom of the late 1990s, the PC Era of the 1980s, and other technology booms but with distinct differences. Although today’s price leaders have significantly stronger cash flows than those of the 90s, the growing popularity in passive market exposure through index investing has added another level of potential risk in today’s equity markets.

We believe Bristol Gate has a role to play in any long-term investment portfolio and index concentration may be signaling that it is the right time to add to our unique exposure for a variety of reasons:

- Allocation: Our unique high dividend growth focus is complementary to growth-focused and index strategies.

- Active share: We consistently invest in ideas that are not index-focused, as evidenced by our high Active Share of 87%. This indicates that our portfolio’s holdings differ significantly from those of the benchmark index.

- Performance: Long-term absolute and risk-adjusted metrics show how a dividend growth focused strategy can provide a positive alternative to a mega cap driven market.

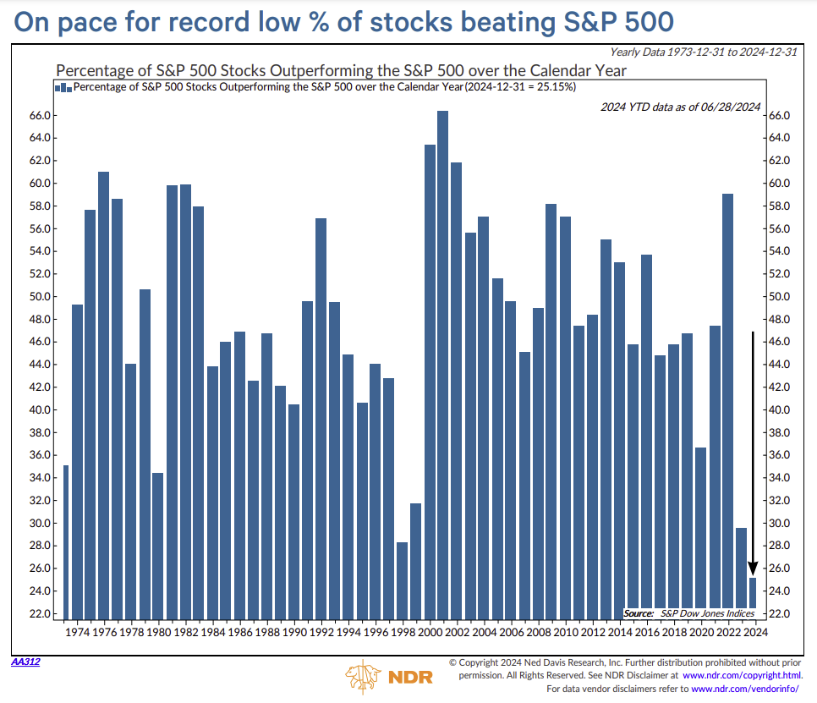

The record low percentage of stocks beating the S&P 500 underscores a stark bifurcation within the market: a few stocks, often grouped together as the “Magnificent 7”, are overwhelmingly driving the broad market’s performance. It is not an exaggeration to state that the narrowness of the current market is unprecedented relative to what we have seen in the last 50 years.

Exhibit 1:

Source: Ned Davis

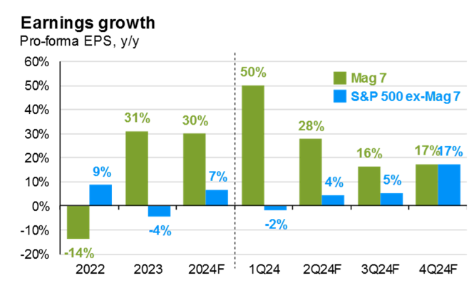

What makes this environment unique from previous markets is that today’s concentration is not centered around hype. The companies driving the market to new highs have delivered staggering earnings growth in an environment of rising interest rates and otherwise muted growth.

Exhibit 2:

Source: JP Morgan Guide to the Markets (July 2024).

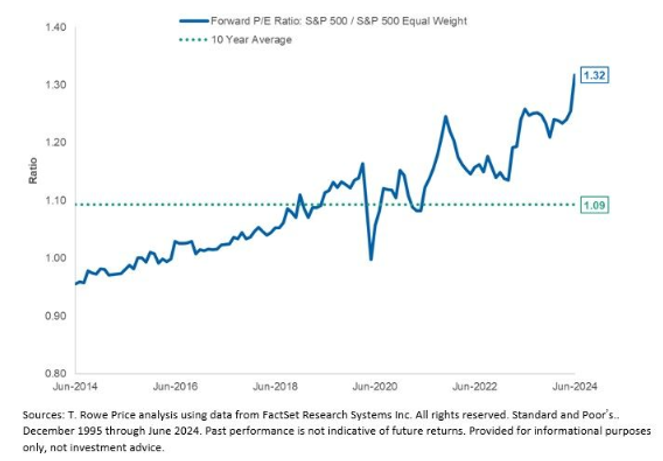

Looking forward, the question for these market leaders is how much of the growth being priced into their stocks is sustainable. On the other hand, are the other 493 companies being fairly valued if an expected broad recovery in earnings growth materializes? Exhibit 3 shows the widening gap between the S&P 500’s performance on a market capitalization weighted basis vs equal weighted basis. This disparity indicates that the largest companies, mostly technology giants, are wielding disproportionate influence over the returns of the index.

Exhibit 3:

Source: T. Rowe Price

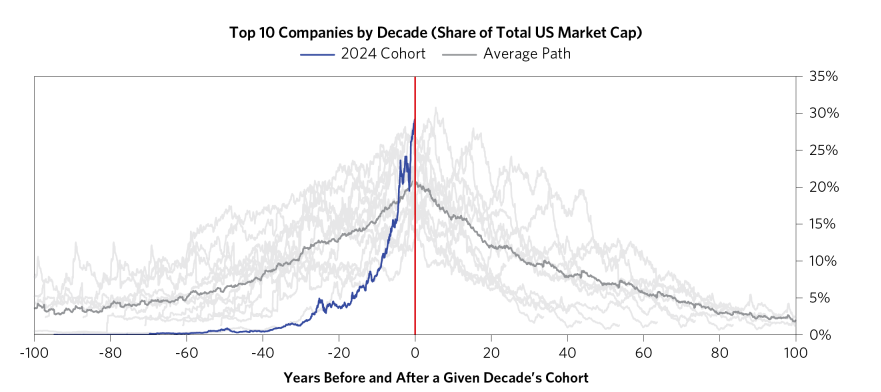

With history as our only guide, we can look back to see how previous instances of companies ascending to such large weights in the index have played out, in terms of concentration and the longevity of that concentration. What we see is that it is unlikely that such levels of concentration last, even as some companies can maintain long periods of dominance.

Exhibit 4:

Source: Bridgewater

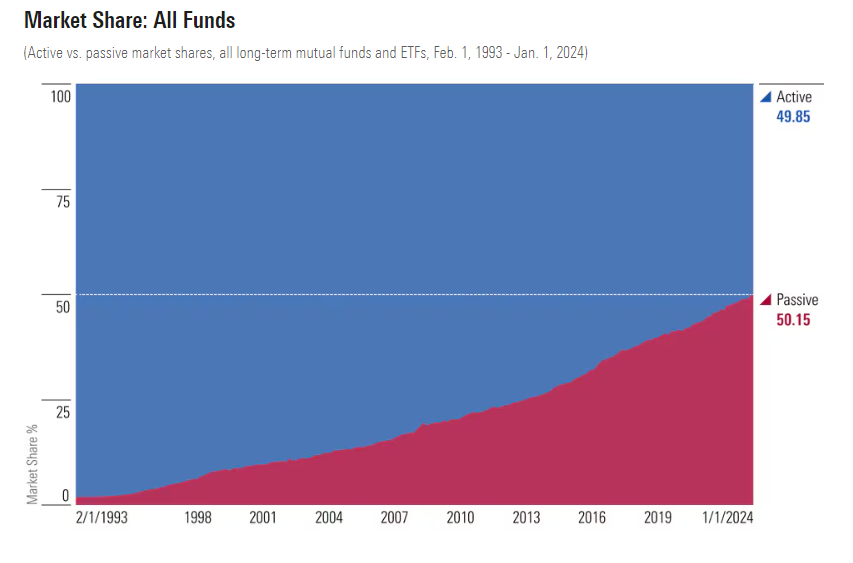

As we indicated earlier, another key difference between the market in the late 1990s is the seismic shift we have seen from active to passive investing. Over the last 30 years, passive funds have gone from less than 2% to today where these funds own over half the market.

Exhibit 5:

Source: Morningstar

This shift exacerbates the concentration issue, as buying into market cap-weighted indices means investors gain a heavy exposure to these few dominant stocks. As a sector, Information Technology has gone from being 18% of the index in 2001 to over 32% today. Owning the market means investors, consciously or not, own a growth portfolio.

In our view, the solution to this concentrated risk is diversification—not through more concentration but through a thoughtful blend of passive and active management. A strategic rebalancing from passive to active strategies allows investors to benefit from the growth of the stocks driving the market. This approach mitigates the dual risks of being over-concentrated in those few names and missing out on the opportunity to invest in broader market segments that may be undervalued.

Bristol Gate’s focus on high dividend growth offers an exposure to high-quality companies beyond the largest companies. Our US Equity portfolio boasts an Active Share of over 87%, meaning an allocation to our strategy would immediately diversify an investor’s portfolio and reduce exposure to the highest weights in the index.

Owning our portfolio doesn’t require giving up on the most attractive segments in the market. Our portfolio companies all enjoy sustainable tailwinds that are helping drive earnings growth, free cash flow growth, and subsequently dividend growth to us as shareholders:

Exhibit 6:

Source: Bristol Gate Capital Partners

Our portfolio continues to benefit from the vast investments being made in Artificial Intelligence (“AI”) through holdings like Microsoft, Broadcom, Applied Materials, and Microchip Technology, but without owning companies that are trading at nosebleed valuations. Active management benefits from under-recognized fundamentals, a case we believe exists right now. By adjusting allocations away from the most overvalued stocks, investors can safeguard against potential downturns and capitalize on growth opportunities across the wider market.

Important Disclosures: There is a risk of loss inherent in any investment; past performance is not indicative of future results. Prospective and existing investors in Bristol Gate’s pooled funds or ETF funds should refer to the fund’s offering documents which outline the risk factors associated with a decision to invest. Separately managed account clients should refer to disclosure documents provided which outline risks of investing. Pursuant to SEC regulations, a description of risks associated with Bristol Gate’s strategies is also contained in Bristol Gate’s Form ADV Part 2A located at www.bristolgate.com/regulatory-documents.This piece is presented for illustrative and discussion purposes only. It should not be considered as personal investment advice or an offer or solicitation to buy and/or sell securities and it does not consider unique objectives, constraints, or financial needs of the individual. Under no circumstances does this piece suggest that you should time the market in any way or make investment decisions based on the content. Investors are advised that their investments are not guaranteed, their values change frequently, and past performance may not be repeated. References to specific securities are presented to illustrate the application of our investment philosophy only, do not represent all of the securities purchased, sold or recommended for the portfolio, it should not be assumed that investments in the securities identified were or will be profitable and should not be considered recommendations by Bristol Gate Capital Partners Inc. A full list of security holdings is available upon request. For more information contact Bristol Gate Capital Partners Inc. directly. The information contained in this piece is the opinion of Bristol Gate Capital Partners Inc. and/or its employees as of the date of the piece and is subject to change without notice. Every effort has been made to ensure accuracy in this piece at the time of publication; however, accuracy cannot be guaranteed. Market conditions may change and Bristol Gate Capital Partners Inc. accepts no responsibility for individual investment decisions arising from the use of or reliance on the information contained herein. We strongly recommend you consult with a financial advisor prior to making any investment decisions. Please refer to the Legal section of Bristol Gate’s website for additional information at bristolgate.com.

A Note About Forward-Looking Statements: This report may contain forward-looking statements including, but not limited to, statements about the Bristol Gate strategies, risks, expected performance and condition. Forward-looking statements include statements that are predictive in nature, that depend upon or refer to future events and conditions or include words such as “may”, “could”, “would”, “should”, “expect”, “anticipate”, “intend”, “plan”, “believe”, “estimate” and similar forward-looking expressions or negative versions thereof.

These forward-looking statements are subject to various risks, uncertainties and assumptions about the investment strategies, capital markets and economic factors, which could cause actual financial performance and expectations to differ materially from the anticipated performance or other expectations expressed. Economic factors include, but are not limited to, general economic, political and market factors in North America and internationally, interest and foreign exchange rates, global equity and capital markets, business competition, technological change, changes in government regulations, unexpected judicial or regulatory proceedings, and catastrophic events. Readers are cautioned not to place undue reliance on forward-looking statements and consider the above-mentioned factors and other factors carefully before making any investment decisions. All opinions contained in forward-looking statements are subject to change without notice and are provided in good faith. Forward-looking statements are not guarantees of future performance, and actual results could differ materially from those expressed or implied in any forward-looking statements. Bristol Gate Capital Partners Inc. has no specific intention of updating any forward-looking statements whether as a result of new information, future events or otherwise, except as required by securities legislation.

Takes 2 minutes

Takes 2 minutes