November 29, 2022

Though inflation and rising rates have dominated the headlines this year, it was not that long ago that investors were scrambling for income through a decade of low interest rates. Realizing the appetite for yield, many companies increased their dividend by any means necessary, hoping to become attractive income options for investors.

One such company is Algonquin Power & Utilities Corp (AQN), of which the Globe & Mail recently declared, “Algonquin’s days as a dividend growth darling are over.”

While on the surface AQN seemed to be the ideal company for our approach, we sold it from our Canadian high dividend growth strategy in 2018 (ETF ticker: BGC). We believe the sale highlighted how Bristol Gate’s integrated human + machine approach led to a better long-term outcome for investors.

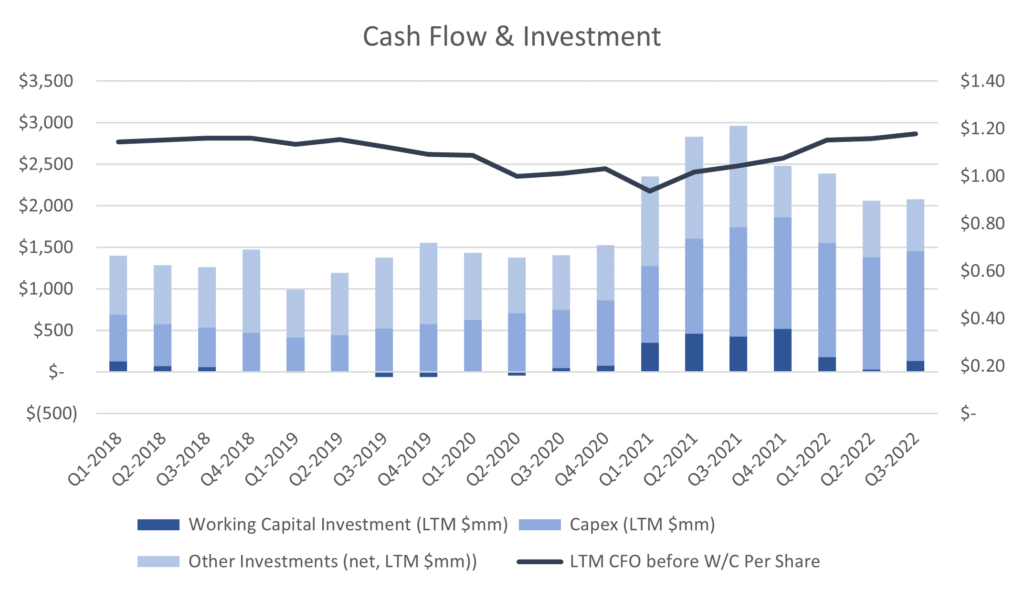

At the time of sale, our dividend growth prediction model continued to forecast attractive dividend growth for the company. Yet, our portfolio managers became concerned about several trends: operating cash flow per share was stagnant despite significant investment in the business and the company needed the capital markets to finance that investment.

Exhibit 1: Algonquin Operating Metrics

Source: Bristol Gate Capital Partners, Canalyst, FactSet

These characteristics were not consistent with those we seek in our investments and our portfolio managers concluded the dividend growth was not sustainable.

After we sold the shares, Algonquin continued to grow its dividend (8.9% compound annual growth rate from 2018-2022) and its shares performed well as the renewable energy sector took off. However, the trends our portfolio managers had identified continued and the company’s payout ratio increased substantially along with its leverage.

We avoid companies with poor returns on investment and a reliance on capital markets to continually fund their business models. Today, market turbulence has raised the cost of issuing debt or equity to prohibitive levels for many companies, including AQN.

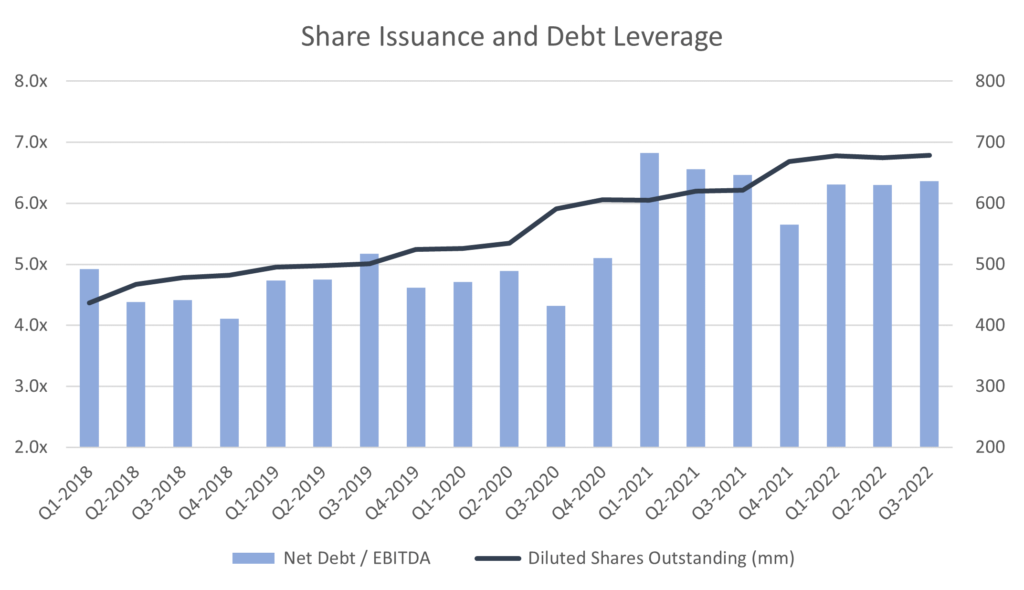

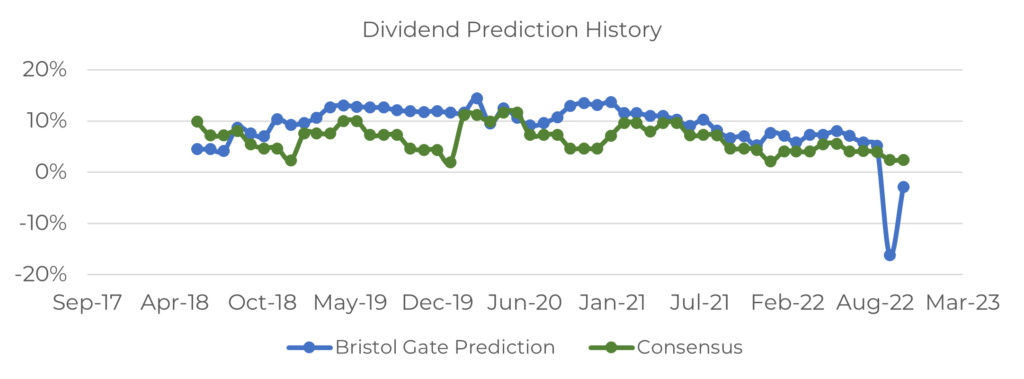

Since 2020, our machine learning model’s predictions for the company’s dividend growth have been on a downward trend. By the end of September this year, our predictions had become markedly negative, confirming our team’s fundamental work.

Exhibit 2: Algonquin Power & Utilities Corp. Dividend Prediction History

Source: Bristol Gate Capital Partners, FactSet

Bristol Gate’s investment strategy is built on buying businesses that are poised to substantially grow their dividend over the next 12 months and beyond. Where many dividend investing strategies focus on a security’s dividend yield today, we have our eyes firmly on what lies beyond the horizon. We think our process and focus on sustainable dividend growth is a more sustainable investment strategy that ultimately leads to attractive long-term returns for our clients and partners.

Important Disclosures

There is a risk of loss inherent in any investment; past performance is not indicative of future results. Prospective and existing investors in Bristol Gate’s pooled funds or ETF funds should refer to the fund’s offering documents which outline the risk factors associated with a decision to invest. Separately managed account clients should refer to disclosure documents provided which outline risks of investing. Pursuant to SEC regulations, a description of risks associated with Bristol Gate’s strategies is also contained in Bristol Gate’s Form ADV Part 2A located at www.bristolgate.com/regulatory-documents.

This piece is presented for illustrative and discussion purposes only. It should not be considered as personal investment advice or an offer or solicitation to buy and/or sell securities and it does not consider unique objectives, constraints, or financial needs of the individual. Under no circumstances does this piece suggest that you should time the market in any way or make investment decisions based on the content. Investors are advised that their investments are not guaranteed, their values change frequently, and past performance may not be repeated. References to specific securities are presented to illustrate the application of our investment philosophy only, do not represent all of the securities purchased, sold or recommended for the portfolio, it should not be assumed that investments in the securities identified were or will be profitable and should not be considered recommendations by Bristol Gate Capital Partners Inc. A full list of security holdings is available upon request. For more information contact Bristol Gate Capital Partners Inc. directly. The information contained in this piece is the opinion of Bristol Gate Capital Partners Inc. and/or its employees as of the date of the piece and is subject to change without notice. Every effort has been made to ensure accuracy in this piece at the time of publication; however, accuracy cannot be guaranteed. Market conditions may change and Bristol Gate Capital Partners Inc. accepts no responsibility for individual investment decisions arising from the use of or reliance on the information contained herein. We strongly recommend you consult with a financial advisor prior to making any investment decisions. Please refer to the Legal section of Bristol Gate’s website for additional information at bristolgate.com.

A Note About Forward-Looking Statements

This report may contain forward-looking statements including, but not limited to, statements about the Bristol Gate strategies, risks, expected performance and condition. Forward-looking statements include statements that are predictive in nature, that depend upon or refer to future events and conditions or include words such as “may”, “could”, “would”, “should”, “expect”, “anticipate”, “intend”, “plan”, “believe”, “estimate” and similar forward-looking expressions or negative versions thereof.

These forward-looking statements are subject to various risks, uncertainties and assumptions about the investment strategies, capital markets and economic factors, which could cause actual financial performance and expectations to differ materially from the anticipated performance or other expectations expressed. Economic factors include, but are not limited to, general economic, political and market factors in North America and internationally, interest and foreign exchange rates, global equity and capital markets, business competition, technological change, changes in government regulations, unexpected judicial or regulatory proceedings, and catastrophic events. Readers are cautioned not to place undue reliance on forward-looking statements and consider the above-mentioned factors and other factors carefully before making any investment decisions. All opinions contained in forward-looking statements are subject to change without notice and are provided in good faith. Forward-looking statements are not guarantees of future performance, and actual results could differ materially from those expressed or implied in any forward-looking statements. Bristol Gate Capital Partners Inc. has no specific intention of updating any forward-looking statements whether as a result of new information, future events or otherwise, except as required by securities legislation.

Takes 2 minutes

Takes 2 minutes