June 26, 2024

At Bristol Gate, we focus on investing in high-quality companies that demonstrate strong potential for high dividend growth. We utilize advanced machine learning algorithms alongside the assessment from our portfolio managers to help determine a company’s dividend growth and quality characteristics. Once we have determined a high level of confidence that a company will grow its dividend at a high rate, we look for specific traits that set these companies apart. What does a Bristol Gate company look like?

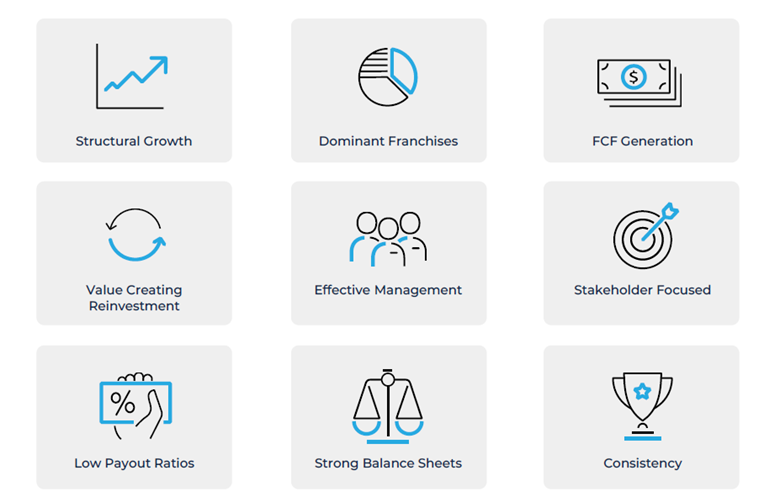

Structural Growth. Companies with strong pricing power and support from secular growth trends tend to exhibit structural growth. These companies can maintain a healthy level of growth over time, thanks to their ability to adapt to long-term market trends and sustain robust pricing strategies.

Dominant Franchises. We prefer companies that are dominant in their respective industries. Typically, these companies are a top three player in their space. This dominance can indicate a competitive advantage, ensuring they can sustain their market position and continue to grow.

Free Cash Flow (FCF) Generation. Companies that generate substantial free cash flow are able to meaningfully reinvest back into their business. While we focus on dividend growth, we like companies that allocate cash flow to high return investment opportunities as well. This reinvestment is crucial because it allows companies to earn high returns on invested capital. As equity owners, we want to see companies use their cash flow to fuel further growth and create additional value which will, in turn, drive future dividend growth.

Value Creating Reinvestment. High-quality companies have significant opportunities for value-creating reinvestment. These businesses can allocate capital effectively, reinvesting in areas that will generate high returns. This reinvestment strategy supports their long-term growth and enhances their overall value.

Effective Management. The best companies are led by management teams that excel at capital allocation. These teams know how to balance reinvestment in their own businesses, dividend growth, share buybacks, and strategic acquisitions to maximize shareholder value. Their ability to make smart capital allocation decisions is a key driver of their long-term success. Additionally, we appreciate when management compensation is aligned with shareholder interests and the long-term performance of the company.

Stakeholder Focused. Quality companies prioritize taking care of their customers, employees, and communities. A strong commitment to stakeholders not only ensures a positive impact on society but also contributes to the company’s sustainability and long-term success.

Low Payout Ratios. A lower payout ratio means the company retains more earnings, providing flexibility for future dividend growth. It also means the company sees significant value creation opportunities. A lower payout ratio often means dividend increases are sustainable over the long term.

Strong Balance Sheets. Financial strength is a non-negotiable trait for Bristol Gate companies. We only invest in companies whose debt is investment grade as rated by major rating agencies. A strong balance sheet ensures stability and reduces financial risk, making these companies more resilient during economic downturns.

Consistency. We value consistency and durability in businesses. Companies that demonstrate consistent performance and predictable results make it easier for us to forecast their future growth. This reliability allows us to sleep easier at night, knowing our investments are in stable, well-managed companies.

Our investment strategy focuses on high dividend growth companies. Within this group, we seek to identify and invest in companies that exhibit some or all of these “quality” traits. By doing so, we aim to build a portfolio of high-quality businesses poised for substantial dividend growth and long-term success.

Important Disclosures: There is a risk of loss inherent in any investment; past performance is not indicative of future results. Prospective and existing investors in Bristol Gate’s pooled funds or ETF funds should refer to the fund’s offering documents which outline the risk factors associated with a decision to invest. Separately managed account clients should refer to disclosure documents provided which outline risks of investing. Pursuant to SEC regulations, a description of risks associated with Bristol Gate’s strategies is also contained in Bristol Gate’s Form ADV Part 2A located at www.bristolgate.com/regulatory-documents.This piece is presented for illustrative and discussion purposes only. It should not be considered as personal investment advice or an offer or solicitation to buy and/or sell securities and it does not consider unique objectives, constraints, or financial needs of the individual. Under no circumstances does this piece suggest that you should time the market in any way or make investment decisions based on the content. Investors are advised that their investments are not guaranteed, their values change frequently, and past performance may not be repeated. References to specific securities are presented to illustrate the application of our investment philosophy only, do not represent all of the securities purchased, sold or recommended for the portfolio, it should not be assumed that investments in the securities identified were or will be profitable and should not be considered recommendations by Bristol Gate Capital Partners Inc. A full list of security holdings is available upon request. For more information contact Bristol Gate Capital Partners Inc. directly. The information contained in this piece is the opinion of Bristol Gate Capital Partners Inc. and/or its employees as of the date of the piece and is subject to change without notice. Every effort has been made to ensure accuracy in this piece at the time of publication; however, accuracy cannot be guaranteed. Market conditions may change and Bristol Gate Capital Partners Inc. accepts no responsibility for individual investment decisions arising from the use of or reliance on the information contained herein. We strongly recommend you consult with a financial advisor prior to making any investment decisions. Please refer to the Legal section of Bristol Gate’s website for additional information at bristolgate.com.

A Note About Forward-Looking Statements: This report may contain forward-looking statements including, but not limited to, statements about the Bristol Gate strategies, risks, expected performance and condition. Forward-looking statements include statements that are predictive in nature, that depend upon or refer to future events and conditions or include words such as “may”, “could”, “would”, “should”, “expect”, “anticipate”, “intend”, “plan”, “believe”, “estimate” and similar forward-looking expressions or negative versions thereof.

These forward-looking statements are subject to various risks, uncertainties and assumptions about the investment strategies, capital markets and economic factors, which could cause actual financial performance and expectations to differ materially from the anticipated performance or other expectations expressed. Economic factors include, but are not limited to, general economic, political and market factors in North America and internationally, interest and foreign exchange rates, global equity and capital markets, business competition, technological change, changes in government regulations, unexpected judicial or regulatory proceedings, and catastrophic events. Readers are cautioned not to place undue reliance on forward-looking statements and consider the above-mentioned factors and other factors carefully before making any investment decisions. All opinions contained in forward-looking statements are subject to change without notice and are provided in good faith. Forward-looking statements are not guarantees of future performance, and actual results could differ materially from those expressed or implied in any forward-looking statements. Bristol Gate Capital Partners Inc. has no specific intention of updating any forward-looking statements whether as a result of new information, future events or otherwise, except as required by securities legislation.

Takes 2 minutes

Takes 2 minutes