September 20, 2024

We are dedicated to identifying high-quality businesses with high prospective dividend growth. We aim to build resilient portfolios, which can withstand market volatility and deliver long-term returns. When it comes to portfolio construction, we spend considerable time thinking about the best way to manage an equally weighted portfolio outside of our regular re-balancing time periods. Our data science team has solved this issue by developing a methodical approach using stock price information to build a “threshold” framework which allows for stocks to rise and fall within certain pricing bands in the interim between re-balancing dates. This allows us to take advantage of the opportunities presented during short-term periods of market euphoria and fear.

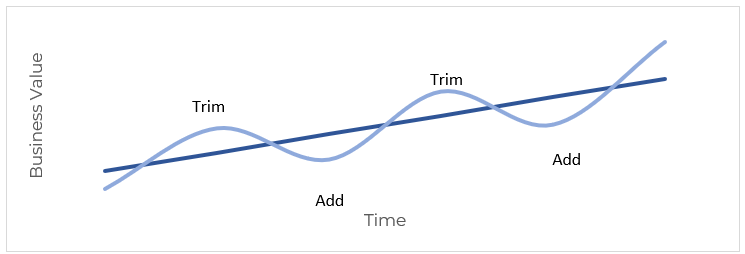

As outlined in Exhibit 1, we have employed a strategic method to reallocate our investments to optimize portfolio performance. When the weight of any stock fluctuates more than 1% from its target equal weight of 4.55%, we automatically trim or add to those positions on a quarterly basis. As an example, a stock that has experienced gains and exceeds the threshold of 1% would be trimmed back to equal weight and in doing so capture profits and reinvest them into a portfolio company that the market may be undervaluing.

Exhibit 1: Bristol Gate Quarterly Rebalancing Approach

Source: Bristol Gate Capital Partners

We implemented this approach in 2021, based on our findings which examined its potential impact on performance. Our previous approach had been rebalancing all names that had deviated from their target weight, bringing the portfolio to equal weight on a quarterly basis. The results of our study determined that not only was there no detrimental impact on performance potential but that this approach to introduce thresholds would likely have a positive impact given the reduced trading costs associated with it.

From a process perspective, we believe this approach has two primary benefits. The first benefit is it acts as a contrarian system: it reduces our exposure to businesses with near-term valuations that may be stretched while simultaneously increasing our exposure to businesses trading at cheaper valuations. The second benefit is it demands conviction. If we are going to add to laggards which have become our smallest positions, we must discuss and determine the validity of our thesis with the investment committee. If the company’s poor performance is more likely a result of fundamental issues rather than short-term volatility, we are more likely to sell the name rather than add to it.

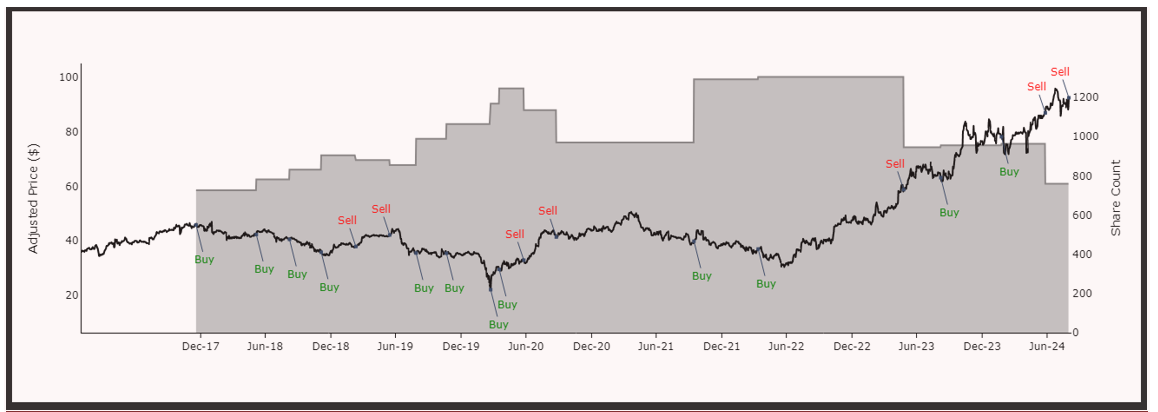

To demonstrate the impact of this rebalancing on the portfolio, we can look at the history of our ownership of Stella-Jones (SJ), one of the longest held names in our Bristol Gate Concentrated Canadian Equity ETF. SJ is a high-quality, high dividend grower that has fallen in and out of favour with the market since we first initiated our position in the company in 2017.

Throughout our ownership of Stella-Jones, our thesis has not changed. It is a market leader in two of its three main operating segments (utility poles and railway ties). It has discernible competitive advantages versus its competitors. Due to its scale, it can offer coast-to-coast service to large customers (such as Tier-1 Railways), as well as SJ’s treating facilities, which are both very hard to replicate. These advantages have allowed Stella-Jones to have a steady increase in sales volumes in both segments driven by maintenance demand. They also have pricing power, giving them the ability to pass on increasing input costs to their customers.

During the COVID pandemic in 2020, lumber prices shot up due to increased home improvement demand. This boosted Stella-Jones’ share price, and we were able to harvest gains twice during that period. Subsequently, as lumber demand normalized and prices fell after the pandemic, SJ’s revenue from its residential lumber segment fell too. Through our fundamental evaluation, we viewed the drop in share price as overly punitive and we were happy to add to the position.

Stella-Jones management’s medium-term guidance and positive quarterly results since mid-2023, driven by strong demand in utility poles due to increased infrastructure spending in the U.S., a large maintenance replacement cycle and an increase in environmental fires, have since helped its stock price reach new all-time highs. Once again allowing us to realize some profits by trimming our shares and reallocating to other under-appreciated names in our portfolio.

Exhibit 2 demonstrates the evolution of our investment in SJ since our initial investment. Stella-Jones’ stock price has gone from ~$45 to ~$92 between Dec 18, 2017 through August 31, 2024, resulting in a 102% cumulative return (or 11.1% annualized). Our rebalancing process has resulted in excess returns of 1.6% per year as opposed to if we had simply bought and held the stock.

Exhibit 2: Bristol Gate US Equity strategy ownership changes in Stella Jones

Source: Bloomberg, Bristol Gate Capital Partners

The key strength of a disciplined and rigorous investment process is its ability to provide consistency, irrespective of market conditions. At Bristol Gate, our investment strategy is firmly grounded in evidence-based methods, which helps us steer clear of emotional or reactionary decisions, regardless of what the market throws at us. This disciplined approach keeps us aligned with the long-term goals of our clients.

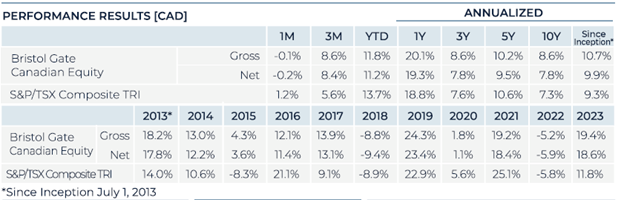

Performance Disclosure (As at August 31, 2024):

Important disclosures

There is a risk of loss inherent in any investment; past performance is not indicative of future results. Prospective and existing investors in Bristol Gate’s pooled funds or ETF funds should refer to the fund’s offering documents which outline the risk factors associated with a decision to invest. Separately managed account clients should refer to disclosure documents provided which outline risks of investing. Pursuant to SEC regulations, a description of risks associated with Bristol Gate’s strategies is also contained in Bristol Gate’s Form ADV Part 2A located at www.bristolgate.com/regulatory-documents.

Strategy returns in this report refer to the Bristol Gate Canadian Equity Strategy Composite (the “Composite”). The Composite consists primarily of equities of publicly traded, dividend paying Canadian companies. The Composite is valued in Canadian Dollars and for comparison purposes is measured against the S&P/TSX. The composite’s Investment Advisor, Bristol Gate Capital Partners Inc., defines itself as a portfolio manager, exempt market dealer and investment fund manager (as per its registration in Ontario, its principal regulator in Canada) and is also a Registered Investment Adviser with the U.S. Securities and Exchange Commission (the “SEC”). The Investment Advisor’s objective is to select companies primarily from the S&P/TSX universe with positive dividend growth and which collectively will generate over the long term a growing income and capital appreciation for investors. The inception date of the Composite is July 1, 2013. Returns are presented gross and net of fees and include the reinvestment of all income. The composite’s gross return is gross of withholding tax prior to January 1, 2017 and is net of withholding tax thereafter. Net returns are calculated by reducing the gross returns by the maximum management fee charged by Bristol Gate of 0.7%, applied monthly. Actual investment advisory fees incurred by clients may vary. An investor’s actual returns may be reduced by management fees, performance fees, and other operating expenses that may be incurred because of the management of the composite. A performance fee may be charged on some accounts and funds managed by the firm. Bristol Gate claims compliance with the Global Investment Performance Standards (GIPS®). GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein. To obtain a GIPS Composite Report, please email us at info@bristolgate.com.

The S&P/TSX Total Return Index measures the performance of the broad Canadian equity market, including dividend re-investment, in Canadian dollars. This index is provided for information only and comparisons to the index have limitations. The benchmark is an appropriate standard against which the performance of the strategy can be measured over longer time periods as it represents the primary investment universe from which Bristol Gate selects securities. However, Bristol Gate’s portfolio construction process differs materially from that of the benchmark and the securities selected for inclusion in the strategy are not influenced by the composition of the benchmark. For example, the strategy is a concentrated portfolio of approximately equally weighted dividend-paying equity securities, rebalanced quarterly whereas the benchmark is a broad stock index (including both dividend and non-dividend paying equities) that is market capitalization weighted. As such, strategy performance deviations relative to the benchmark may be significant, particularly over shorter time periods. The strategy has concentrated investments in a limited number of companies; as a result, a change in one security’s value may have a more significant effect on the strategy’s value.

This piece is presented for illustrative and discussion purposes only. It should not be considered as personal investment advice or an offer or solicitation to buy and/or sell securities and it does not consider unique objectives, constraints, or financial needs of the individual. Under no circumstances does this piece suggest that you should time the market in any way or make investment decisions based on the content. Investors are advised that their investments are not guaranteed, their values change frequently, and past performance may not be repeated. References to specific securities are presented to illustrate the application of our investment philosophy only, do not represent all of the securities purchased, sold or recommended for the portfolio, and it should not be assumed that investments in the securities identified were or will be profitable and should not be considered recommendations by Bristol Gate Capital Partners Inc. A full list of security holdings is available upon request. For more information contact Bristol Gate Capital Partners Inc. directly. The information contained in this piece is the opinion of Bristol Gate Capital Partners Inc. and/or its employees as of the date of the piece and is subject to change without notice. Every effort has been made to ensure accuracy in this piece at the time of publication; however, accuracy cannot be guaranteed. Market conditions may change and Bristol Gate Capital Partners Inc. accepts no responsibility for individual investment decisions arising from the use of or reliance on the information contained herein. We strongly recommend you consult with a financial advisor prior to making any investment decisions. Please refer to the Legal section of Bristol Gate’s website for additional information at bristolgate.com.

A Note About Forward-Looking Statements

This report may contain forward-looking statements including, but not limited to, statements about the Bristol Gate strategies, risks, expected performance and condition. Forward-looking statements include statements that are predictive in nature, that depend upon or refer to future events and conditions or include words such as “may”, “could”, “would”, “should”, “expect”, “anticipate”, “intend”, “plan”, “believe”, “estimate” and similar forward-looking expressions or negative versions thereof.

These forward-looking statements are subject to various risks, uncertainties and assumptions about the investment strategies, capital markets and economic factors, which could cause actual financial performance and expectations to differ materially from the anticipated performance or other expectations expressed. Economic factors include, but are not limited to, general economic, political and market factors in North America and internationally, interest and foreign exchange rates, global equity and capital markets, business competition, technological change, changes in government regulations, unexpected judicial or regulatory proceedings, and catastrophic events.

Readers are cautioned not to place undue reliance on forward-looking statements and consider the above-mentioned factors and other factors carefully before making any investment decisions. All opinions contained in forward-looking statements are subject to change without notice and are provided in good faith. Forward-looking statements are not guarantees of future performance, and actual results could differ materially from those expressed or implied in any forward-looking statements. Bristol Gate Capital Partners Inc. has no specific intention of updating any forward-looking statements whether as a result of new information, future events or otherwise, except as required by securities legislation.

Takes 2 minutes

Takes 2 minutes