June 6, 2024

Introduction to Bristol Gate and Our Investment Approach

We are committed to a disciplined investment strategy that focuses on owning high dividend growth companies. Our process combines advanced machine learning predictions with detailed fundamental analysis to create a portfolio that strives for both growth and stability. This blog post will go through our 4-pillar investment process and an example of our buy and sell discipline going through a previous trade selling Home Depot and buying Lowe’s. These four pillars form our investment process and are used to determine each addition or removal of a company in the portfolio.

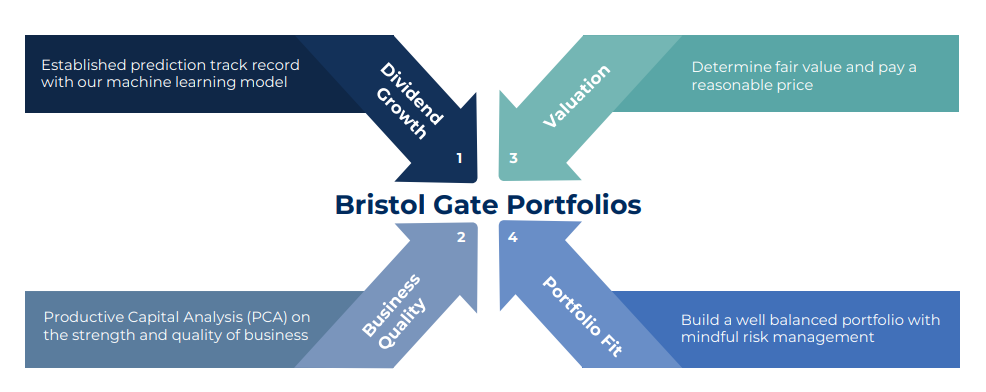

The Four Pillar Investment Process

Our investment process begins with our proprietary machine learning model. The model is used to predict the future dividend growth of each company in our universe, where the highest predicted dividend growers form the focus list for our portfolio managers to conduct Productive Capital Analysis. Productive Capital Analysis is used to validate the dividend prediction, as well as evaluate the strength and quality of a business. If a company shows high predicted dividend growth and strong business quality, we move to the third pillar, where we determine the fair value of the company to ensure we pay a reasonable price. The final pillar concludes the investment process by assessing the overall portfolio with strong risk management practices in place. Correlation and principal component analysis are used together to evaluate whether the portfolio is adequately diversified.

These four pillars are used to determine not only whether a company could be added to the portfolio, but also to evaluate whether a company should be removed from the portfolio. If a company’s predicted dividend growth has slowed, its business quality has weakened, its valuation has become less appealing, or portfolio fit has worsened, or perhaps there are simply better alternatives available to us, the company will be identified as a potential candidate for removal from the portfolio.

Purchasing Home Depot

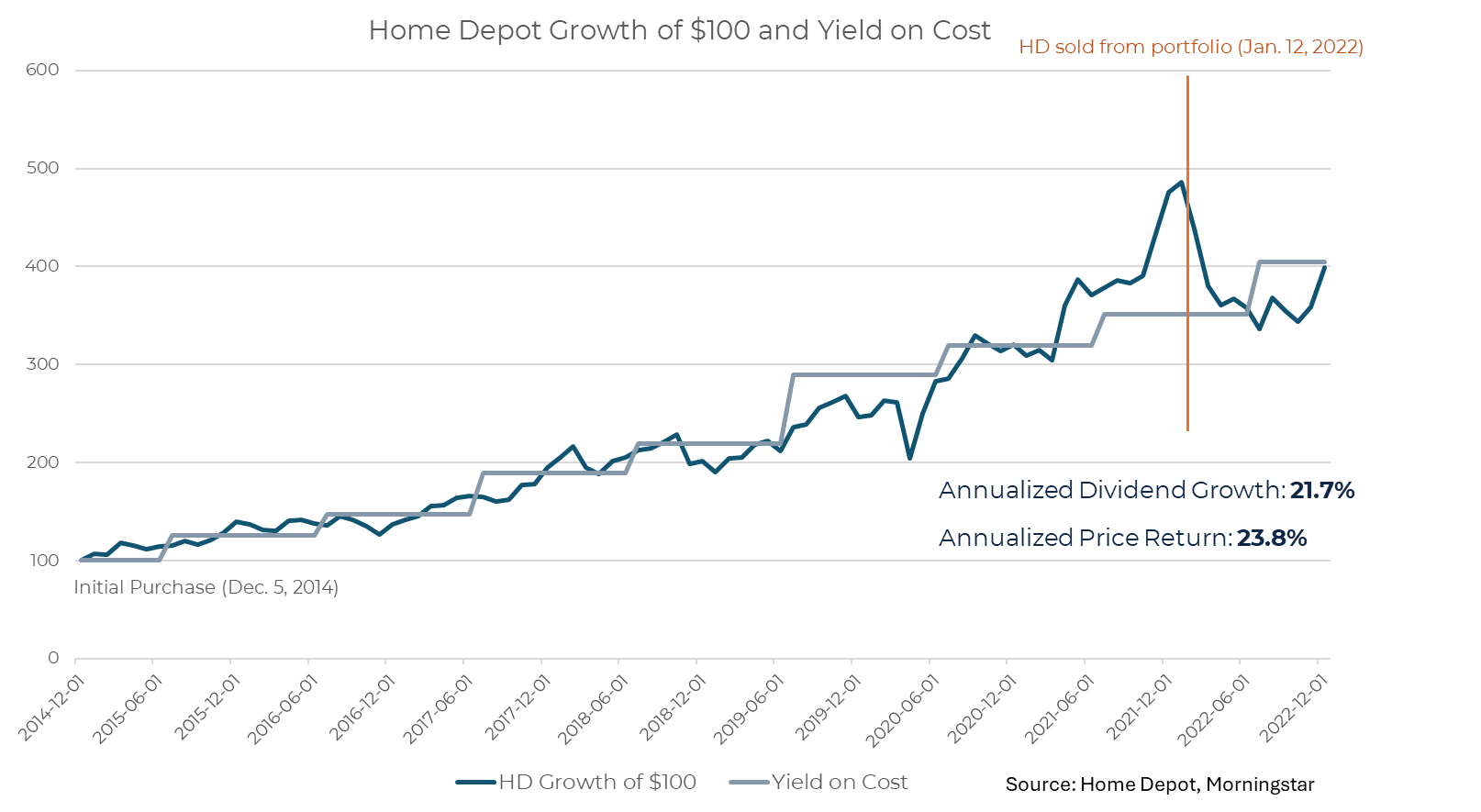

Our initial acquisition of Home Depot in December 2014 illustrates how our 4-pillar investment process works in practice.

Dividend Growth. As the impact of the Global Financial Crisis on US Consumers and the housing market began to wane, Home Depot began to accelerate its dividend growth in 2013. After experiencing approximately 10% growth in the previous two years, the company’s dividend growth jumped to 35% in 2013 and 21% in 2014. Our model forecasted a continuation of the trend, predicting 18% dividend growth in 2015 on the back of strong free cash flow growth and a reasonable payout ratio.

This consistent upsurge in dividends was a strong indicator of the company’s financial health and growth potential, meeting our primary criterion of identifying high dividend growth.

Business Quality. At the time, Home Depot stood out as a high-quality business with strong operational metrics. Its market leadership in the home improvement sector and consistent performance in enhancing shareholder value reflected the company’s robust management and business model.

Exiting the global financial crisis, economic uncertainty remained high. Housing prices had declined, leaving many homeowners opting to renovate and improve their existing homes rather than buy new ones or invest in large-scale construction projects in the subsequent years. This shift in consumer behavior led to increased demand for home improvement products and services. Home Depot, as one of the largest home improvement retailers in the world, was a beneficiary of this trend for several reasons:

- Market Dominance: Home Depot’s strong market position and extensive network of stores allowed it to capture a significant portion of the increased demand for home improvement products. Its widespread presence made it convenient for consumers to access the materials and tools they needed for their projects. In addition, its financial strength allowed it to invest in distribution, products, and marketing when smaller competitors were struggling to survive.

- Focus on DIY Market: Home Depot has historically catered to do-it-yourself (DIY) enthusiasts, offering a wide range of products and resources for homeowners looking to tackle projects themselves. Following the financial crisis, many consumers turned to DIY renovations as a cost-effective alternative to hiring professionals, further boosting Home Depot’s sales.

- Competitive Pricing: Home Depot’s competitive pricing and promotional strategies appealed to budget-conscious consumers.

- Professional Services: In addition to serving the DIY market, Home Depot also provides products and services for professional contractors and tradespeople. Despite the economic downturn, there was still demand for home improvement projects that required professional expertise, and Home Depot was able to capitalize on this segment of the market as well.

Overall, Home Depot was seen as a high-quality business with sustainable operational strengths. The company’s market dominance, focus on the DIY market, competitive pricing, and offerings for professional contractors were key factors that enabled it to navigate the challenges of the Global Financial Crisis. These factors also positioned Home Depot to benefit from the rising demand for home improvement products as the housing market started to recover and affordability remained appealing. They supported the conclusion that Home Depot could provide attractive dividend growth going forward.

Fair Valuation. Although trading at a premium valuation multiple relative to its recent past when we acquired Home Depot, we thought it presented a fair value given its growth prospects and business quality. The company’s P/E ratio and other valuation metrics were aligned with its high growth rates in dividends and earnings, justifying our investment based on not overpaying for the expected growth and returns.

Portfolio Fit and Diversification. Adding Home Depot to our portfolio in 2014 also aligned well with our goal of maintaining a diversified and balanced portfolio. As a leading player in the retail sector, Home Depot provided sectoral balance and contributed to the portfolio’s overall risk management strategy by offsetting exposure to more volatile industries.

The Outcome

Our investment in Home Depot yielded impressive results, reflecting our core belief that income growth leads to capital growth. Over our holding period, Home Depot achieved an annualized price return of approximately 23.8% and an annualized dividend growth of approximately 21.7%.

Home Depot’s Replacement

As the years progressed, a pivotal factor in our decision to sell Home Depot was the forecast from our dividend growth prediction model, which began to indicate a slowdown in future dividend growth relative to other opportunities available to us. This was a significant concern since consistent and robust dividend growth is a central pillar in our investment strategy. In addition to our model’s deteriorating prediction, a less attractive valuation after years of growth prompted a thorough revaluation under our four pillars.

This reassessment coincided with recognizing an appealing opportunity in Lowe’s. In early 2022, our analysis showed that Lowe’s not only offered similar business qualities and sector positioning but came with better dividend growth prospects and a more attractive valuation. Lowe’s had demonstrated a significant dividend increase, over 30% in 2022, surpassing Home Depot during the same period. Furthermore, Lowe’s traded at a lower multiple, which presented a better value opportunity. These factors made Lowe’s a compelling choice to replace Home Depot, more correctly aligning with our valuation and growth pillars.

The Importance of Structured Investment Process

The switch from Home Depot to Lowe’s exemplifies the role of our structured investment process. Our commitment to a disciplined, analytical approach ensures each decision is deeply grounded in data, helping us systematically ignore market noise and focus on fundamental growth drivers. When our dividend growth prediction model indicated a slowdown in Home Depot’s future dividend increases, our well-defined criteria promptly guided us toward a better opportunity with Lowe’s.

This structured approach to investment management is crucial for maintaining consistency and shields our decision-making from the volatility of market sentiments, promoting stable, sustainable growth. By adhering to this rigorous framework, we enhance our ability to achieve superior long-term outcomes for our clients, ensuring our investment choices align seamlessly with our strategic objectives.

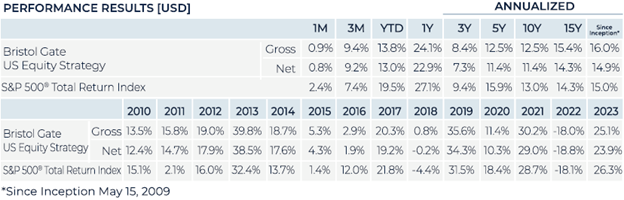

Performance Disclosure (As at August 31, 2024):

Important disclosures

There is a risk of loss inherent in any investment; past performance is not indicative of future results. Prospective and existing investors in Bristol Gate’s pooled funds or ETF funds should refer to the fund’s offering documents which outline the risk factors associated with a decision to invest. Separately managed account clients should refer to disclosure documents provided which outline risks of investing. Pursuant to SEC regulations, a description of risks associated with Bristol Gate’s strategies is also contained in Bristol Gate’s Form ADV Part 2A located at www.bristolgate.com/regulatory-documents.

US Equity Strategy returns in this report refer to the Bristol Gate US Equity Strategy Composite (the “Composite”). The Composite consists of equities of publicly traded, dividend paying US companies. The Composite is valued in US Dollars and for comparison purposes is measured against the S&P 500 Total Return Index. The composite’s Investment Advisor, Bristol Gate Capital Partners Inc., defines itself as a portfolio manager, exempt market dealer and investment fund manager (as per its registration in Ontario, its principal regulator in Canada) and is also a Registered Investment Adviser with the U.S. Securities and Exchange Commission (the “SEC”). The Investment Advisor’s objective is to select companies with positive dividend growth, and which collectively will generate over the long term a growing income and capital appreciation for investors. The inception date of the Composite is May 15, 2009. The US Dollar is the currency used to measure performance, which is presented on a gross and net basis and includes the reinvestment of investment income. The composite’s gross return is gross of withholding tax prior to January 1, 2017 and is net of withholding tax thereafter. Net returns are calculated by reducing the gross returns by the maximum management fee charged by Bristol Gate of 1%, applied monthly. Actual investment advisory fees incurred by clients may vary. There is the opportunity for the use of leverage up to 30% of the net asset value of the underlying investments using a margin account at the prime broker. Thus far no material leverage has been utilized. An investor’s actual returns may be reduced by management fees, performance fees, and other operating expenses that may be incurred because of the management of the composite. A performance fee may also be charged on some accounts and funds managed by the firm. Bristol Gate claims compliance with the Global Investment Performance Standards (GIPS®). GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein. To obtain a GIPS Composite Report, please email us at info@bristolgate.com.

The S&P 500® Total Return Index measures the performance of the broad US equity market, including dividend re-investment, in US dollars. This index is provided for information only and comparisons to the index has limitations. The benchmark is an appropriate standard against which the performance of the strategy can be measured over longer time periods as it represents the primary investment universe from which Bristol Gate selects securities. However, Bristol Gate’s portfolio construction process differs materially from that of the benchmark and the securities selected for inclusion in the strategy are not influenced by the composition of the benchmark. For example, the strategy is a concentrated portfolio of approximately equally weighted dividend-paying equity securities, rebalanced quarterly whereas the benchmark is a broad stock index (including both dividend and non-dividend paying equities) that is market capitalization weighted. As such, strategy performance deviations relative to the benchmark may be significant, particularly over shorter time periods. The strategy has concentrated investments in a limited number of companies; as a result, a change in one security’s value may have a more significant effect on the strategy’s value.

This piece is presented for illustrative and discussion purposes only. It should not be considered as personal investment advice or an offer or solicitation to buy and/or sell securities and it does not consider unique objectives, constraints, or financial needs of the individual. Under no circumstances does this piece suggest that you should time the market in any way or make investment decisions based on the content. Investors are advised that their investments are not guaranteed, their values change frequently, and past performance may not be repeated. References to specific securities are presented to illustrate the application of our investment philosophy only, do not represent all of the securities purchased, sold or recommended for the portfolio, and it should not be assumed that investments in the securities identified were or will be profitable and should not be considered recommendations by Bristol Gate Capital Partners Inc. A full list of security holdings is available upon request. For more information contact Bristol Gate Capital Partners Inc. directly. The information contained in this piece is the opinion of Bristol Gate Capital Partners Inc. and/or its employees as of the date of the piece and is subject to change without notice. Every effort has been made to ensure accuracy in this piece at the time of publication; however, accuracy cannot be guaranteed. Market conditions may change and Bristol Gate Capital Partners Inc. accepts no responsibility for individual investment decisions arising from the use of or reliance on the information contained herein. We strongly recommend you consult with a financial advisor prior to making any investment decisions. Please refer to the Legal section of Bristol Gate’s website for additional information at bristolgate.com.

A Note About Forward-Looking Statements

This report may contain forward-looking statements including, but not limited to, statements about the Bristol Gate strategies, risks, expected performance and condition. Forward-looking statements include statements that are predictive in nature, that depend upon or refer to future events and conditions or include words such as “may”, “could”, “would”, “should”, “expect”, “anticipate”, “intend”, “plan”, “believe”, “estimate” and similar forward-looking expressions or negative versions thereof.

These forward-looking statements are subject to various risks, uncertainties and assumptions about the investment strategies, capital markets and economic factors, which could cause actual financial performance and expectations to differ materially from the anticipated performance or other expectations expressed. Economic factors include, but are not limited to, general economic, political and market factors in North America and internationally, interest and foreign exchange rates, global equity and capital markets, business competition, technological change, changes in government regulations, unexpected judicial or regulatory proceedings, and catastrophic events. Readers are cautioned not to place undue reliance on forward-looking statements and consider the above-mentioned factors and other factors carefully before making any investment decisions. All opinions contained in forward-looking statements are subject to change without notice and are provided in good faith. Forward-looking statements are not guarantees of future performance, and actual results could differ materially from those expressed or implied in any forward-looking statements. Bristol Gate Capital Partners Inc. has no specific intention of updating any forward-looking statements whether as a result of new information, future events or otherwise, except as required by securities legislation.

Takes 2 minutes

Takes 2 minutes